Imagine that your boss gave you a pay raise but at the same time reduced your scheduled hours. Would you end up with more money in your paycheck, or less? That would depend on the specifics -- how big a raise and how much of a cut. You might be earning less despite the “raise.”

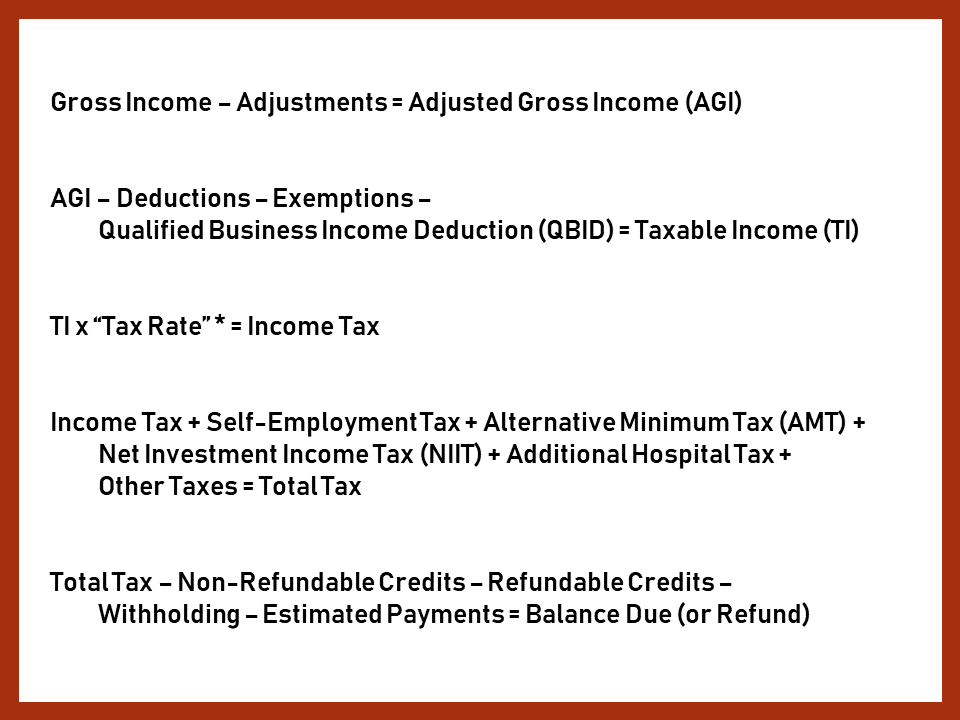

There is a similar see-saw effect at work in your tax calculations. The tax rate alone doesn’t determine how much tax you pay. The government also dictates how much of your income your tax will be calculated, and that can offset any rate reduction. With significant changes to how your taxable income is calculated, you might even end up paying more.

For 2018, tax rates did go down. However, we have lots of changes in how your taxable income is determined. Some of them are in your favor (lowering taxable income) while others are not.

It’s a common misconception that if you jump to a new tax bracket, you’ll pay a higher rate on all your income but fortunately that isn’t the case. Your first “chunk” of taxable income gets taxes at the lowest rate, 10%. Once you’ve filled that bracket, the next chunk gets taxed at the second bracket, 12%. Only the highest portion of your taxable income is taxed at your highest bracket (tax geeks call that your “marginal tax rate”). CNN has a comparison of the 2017 and 2018 brackets.

There’s a lot more to determining your tax than your tax rate, and we’ll be looking at some of the details over the next few weeks. The good news is that for many people – perhaps 55 to 75% -- overall income tax will go down.

However, paying less tax doesn’t always mean you’ll be getting a bigger refund. In fact, many taxpayers could be in for an ugly surprise this year, as we’ll cover in our next post.